Strategic & Financial Matters:

1) As stated in the Management Discussion and Analysis, non-performance of certain sales contract by the Chinese buyers had resulted the Group to incur a loss of RM18 million in FY2015.

(a) What is the percentage of

sales contract with the Chinese buyers to the total revenue of the Group and

what is the outstanding contract value as at 30 June 2015?

The

percentage of sales contract with the defaulted Chinese Buyers was accounted

for 3% to the total revenue of the Group and the Group had fully diverted the

sales to other local Chinese buyers in FY2015. Hence, nil outstanding contract

value as at 30 June 2015.

(b) Would the Group expect any

further loss from these contracts in FY2016 in view of weak commodity market

and slow China economy?

No

further loss were resulted from these contracts in FY2016 were noted as the

Group had fully diverted the sales to other local Chinese buyers in FY2015.

More

stringent customer profile review procedures were adopted to prevent the

occurrence of the same again in the future.

2) Note 26 to the Financial Statement stated that the Group has breached the financial covenants of a bank with total outstanding balance of RM263 million at 30 June 2015, relating to the requirement to maintain a current ratio and debt service coverage ratio of not less than 1.0 and not less than 1.2 respectively. The bank has provided a waiver on these financial covenants until 30 June 2016.

What

measures have been taken by the Board to achieve the required ratios and what

would be the penalties for non-fulfillment of the conditions by 30 June 2016?

The Board has taken the

following measures in order to achieve the required ratios:

i) possibility of monetising certain of its assets

in China, depending on the pricing offered for these assets. The Group has

engaged an adviser for the matter and targeted to achieve this in 2016;

ii) in the process of negotiation

with banks for loan restructuring exercise; and

iii) exercising certain internal streamlining and

restructuring processes to reduce the operating costs of the less performing

units to the minimum.

These measures if implemented successfully will

improve the overall financial position of the Group.

No penalties have been imposed by bank for the

non-fulfillment of the conditions by 30 June 2016.

3) As

disclosed in Note 26 to the Financial Statements, total loans and borrowings of

the Group stood at RM680 million, out of which RM395 million is due in FY2016.

Could

the board provide the details of the loans and borrowing denominated in foreign

currencies as at 30 June 2015.

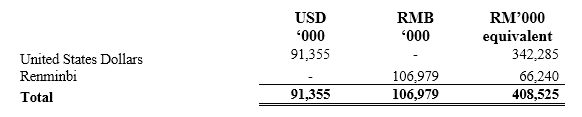

Loans

and borrowings denominated in foreign currencies as at 30 June 2015:

What

is the term loan amount due in FY2016?

Total

Group term loans amounted to approximately RM78.6 million to be due in FY2016.

4) We

noted that trade receivables which had past due as at 30 June 2015 increased to

RM20.075 million from RM2.525 million as at 30 June 2014, despite decline in

revenue for FY2015. The increase in receivables was one of the main factors

that had caused negative net cash generated from operating activities for

FY2015.

(a) What was the reason for the

increase in past-due receivables and how much of these receivables have been

recovered to-date?

The

increase in past-due receivables was mainly due to certain China buyers were

given credit period ranging from 3 to 6 months. As of to-date, all have been

fully settled by the debtors.

(b) What are the measures taken by the Group to improve collection of trade receivables?

Measures

taken by the Group to improve collection of trade receivables include:

i) selection of good creditability trade receivables;

ii) reward efficient payment system; and

iii) negotiate payment terms aggressively.

TOP

TOP